The post Medicare Open Enrollment Starts Today: What You Need to Know first appeared on SafeMoney.com.

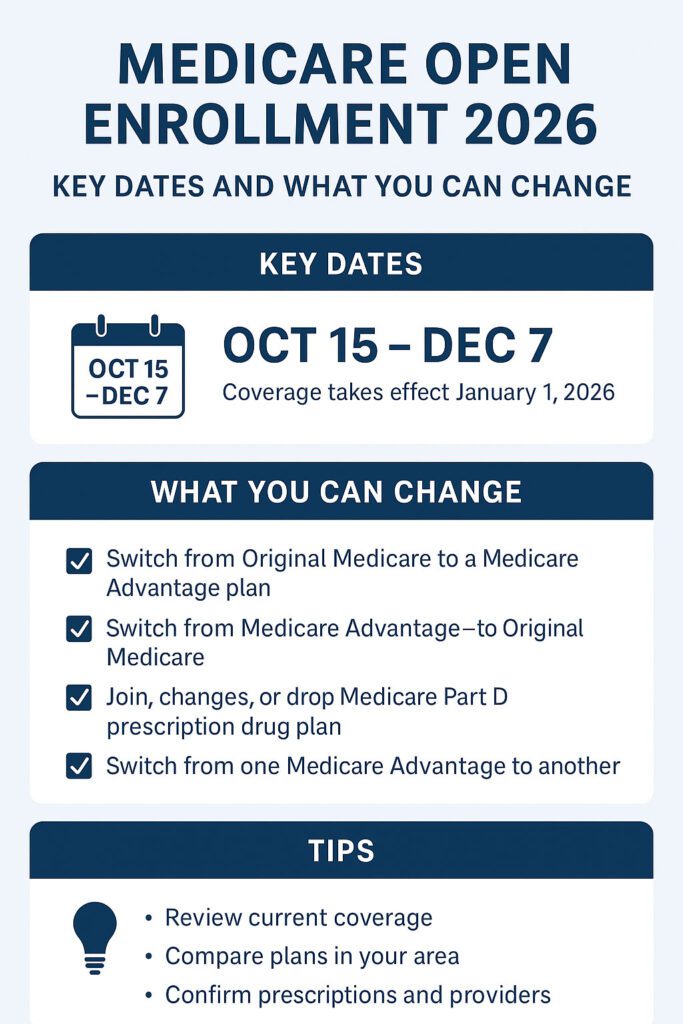

Today marks the start of Medicare’s Annual Election Period (AEP)—October 15 through December 7. During this time, beneficiaries can review and adjust health and prescription drug plans for the coming year.

Any changes you make now will go into effect January 1, 2026.

Missing this window could leave you stuck in a plan that’s no longer optimal—or paying higher charges in some cases.

During this period, Medicare beneficiaries can:

If you don’t take any action, your current coverage will generally automatically renew for 2026—unless your plan is discontinued or significantly changed.

When comparing plans this year, don’t just look at premiums. Some of the key updates and cost shifts include:

Because of these shifts, a plan that looked good last year might not be the best fit now.

Each plan sends this document—review it carefully for cost, coverage, or provider network changes.

The official Medicare.gov tool lets you compare plans side by side based on your prescriptions and providers.

Confirm that your doctors and preferred pharmacies remain in-network under any plan you consider.

Drug tiers and coverage rules can shift yearly—make sure your medications remain covered affordably.

Look beyond premiums to deductibles, copays, and coinsurance limits when comparing plans.

Free State Health Insurance Assistance Programs (SHIPs) and licensed professionals can help you navigate your options.

Reviewing early gives you more time to make confident, informed choices.

Medicare isn’t just about healthcare—it’s a key part of your overall retirement income strategy. Choosing the right plan can protect your nest egg by lowering out-of-pocket costs and preventing unexpected expenses.

If rising Medicare costs or plan changes create an income gap, you may need to revisit your income sources—such as Social Security timing, annuities, or tax-efficient withdrawals—to keep your plan balanced.

| Action | Why It Matters |

|---|---|

| Review your current plan’s changes | Some plans shift benefits or raise costs each year |

| Compare new plans in your area | You may find better value or improved drug coverage |

| Confirm your doctors and prescriptions | Avoid disruptions in your care or pharmacy access |

| Enroll early | Prevents processing delays or coverage gaps |

| Get professional or SHIP help | Trained counselors can help avoid costly mistakes |

Medicare Open Enrollment begins today. Don’t let this opportunity pass by. With premiums, networks, and coverage details changing for 2026, now is the time to review your options.

Take a few minutes to compare your plan, confirm your doctors and prescriptions, and make any necessary adjustments before December 7. Small actions now can prevent big costs later—and help protect both your health and your financial future.

Sources: Centers for Medicare & Medicaid Services (CMS), National Council on Aging (NCOA), Medicare.gov, Medicare Resources, PAN Foundation, NerdWallet, Investopedia, Kiplinger

Disclaimer: This article is for educational and informational purposes only. It is not medical, legal, or financial advice. Please consult licensed professionals about your specific Medicare, insurance, or retirement situation. SafeMoney.com is not affiliated with or endorsed by any government agency.

The post Medicare Open Enrollment Starts Today: What You Need to Know first appeared on SafeMoney.com.

]]>The post Protect What You’ve Built: Managing Risk in Retirement first appeared on SafeMoney.com.

]]>After decades of saving, investing, and preparing for retirement, the last thing you want is for unexpected risks to threaten your financial security. Yet, that’s exactly what happens to many retirees who underestimate how unpredictable retirement can be.

October’s National Financial Planning Awareness Month is the perfect reminder that a strong plan isn’t just about earning more—it’s about protecting what you’ve earned.

Let’s explore the most common risks retirees face and the strategies you can use to safeguard your savings.

| Risk | Why It Matters | Protection Strategy |

|---|---|---|

| Market Volatility | Market downturns can erode principal and reduce income. | Fixed Indexed Annuities (FIAs) provide market-linked growth with no downside losses. |

| Longevity Risk | Living longer than expected can stretch savings too thin. | Annuities and guaranteed lifetime income options ensure income for life. |

| Healthcare & Long-Term Care | Medical and LTC expenses are often underestimated. | LTC riders or hybrid life insurance policies offer coverage and asset protection. |

| Inflation | Rising costs can erode purchasing power. | Assets with growth potential, such as FIAs or inflation-adjusted annuities, help offset inflation. |

| Taxes | Withdrawals from retirement accounts may trigger higher taxes. | Tax diversification through Roth accounts and planned withdrawals can minimize impact. |

Market downturns hurt most when they happen early in retirement—when withdrawals compound losses.

This is called sequence-of-returns risk. For example:

Two retirees with identical portfolios can experience dramatically different outcomes based solely on when a market decline occurs.

Safe Money Strategy:

Protect a portion of your portfolio in vehicles that can’t lose value, such as fixed indexed annuities (FIAs). They offer potential market-linked growth while preserving principal from losses.

People are living longer than ever—many well into their 80s and 90s. The challenge? Your retirement income needs to last as long as you do.

How to Plan for Longevity:

Remember: Longevity amplifies every other risk—from inflation to healthcare. Planning early reduces those compounding effects.

Even with Medicare, healthcare expenses can add up. Fidelity estimates the average couple retiring at 65 will spend over $315,000 on healthcare alone during retirement.

Long-Term Care (LTC) Risk:

A single extended care event can drain savings quickly.

Protection Options:

Planning early locks in lower premiums and ensures coverage when you need it most.

Even moderate inflation can quietly erode your retirement income over time.

Example:

At 3% inflation, $60,000 today will only buy what $33,000 does in 20 years.

Protection Strategies:

Taxes don’t stop at retirement—they just change form. Distributions from IRAs, 401(k)s, and pensions are usually taxable. Without planning, this can reduce your take-home income and trigger higher Medicare premiums.

Tax-Efficient Strategies:

A proactive tax strategy can save thousands over your retirement years.

Safe money doesn’t mean no growth—it means no unnecessary risk. By combining guaranteed income sources (like annuities) with flexible, conservative investments, you can reduce volatility while still pursuing growth.

This balance between protection and participation helps keep your income steady, your savings safe, and your confidence high—no matter what happens in the market.

You’ve worked a lifetime to build your retirement. Don’t leave your future vulnerable to risks you can prepare for today.

This Financial Planning Awareness Month, make it your mission to protect what you’ve built—because the best time to safeguard your retirement is before something unexpected happens.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of experience helping families navigate retirement and legacy planning, Brent is committed to making financial education simple, clear, and trustworthy.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of experience helping families navigate retirement and legacy planning, Brent is committed to making financial education simple, clear, and trustworthy.

Disclaimer: This article is for informational and educational purposes only and should not be construed as financial, tax, or legal advice. Consult a licensed professional regarding your specific situation. SafeMoney.com is not affiliated with or endorsed by any government agency.

The post Protect What You’ve Built: Managing Risk in Retirement first appeared on SafeMoney.com.

]]>The post Turning Savings Into Income: Your Lifetime Paycheck Plan first appeared on SafeMoney.com.

]]>You’ve spent decades saving and investing for retirement. But when the paycheck stops, the real question becomes: how do you turn those savings into reliable income for life?

October’s National Financial Planning Awareness Month reminds us that accumulation is only half the journey—the other half is distribution. Without a plan for lifetime income, even a strong nest egg can feel uncertain.

Let’s explore how you can turn your retirement savings into a predictable, stress-free paycheck you can count on.

During your working years, your focus is simple: save, grow, and invest. But retirement changes everything. The goal shifts from growth to income stability—and that requires different strategies.

A well-designed income plan should:

Start by listing your reliable, predictable income streams. These typically include:

If those don’t cover all your expenses, you have an income gap—and that’s where other strategies come in.

Annuities are one of the most effective ways to create a personal pension. They transform a portion of your savings into guaranteed lifetime income—no matter how long you live.

Types of annuities to consider:

| Annuity Type | How It Works | Best For |

|---|---|---|

| Fixed Annuity | Pays a guaranteed interest rate | Very conservative savers |

| Fixed Indexed Annuity (FIA) | Links growth to a market index without risk of loss | Those wanting balance between growth and safety |

| Immediate Annuity | Starts paying income right away | Retirees needing income now |

| Deferred Income Annuity (DIA) | Delays income to a future date for higher payouts | Planning for future income streams |

Why it matters: Unlike investments, annuities guarantee income for life—even if markets drop or you live past 100.

When to claim Social Security is one of the biggest financial decisions you’ll make. Taking it early (age 62) locks in a smaller benefit, while waiting until age 70 can increase payments by up to 8% per year.

Example: A retiree eligible for $2,000/month at 62 could receive nearly $2,600/month at 67—or $3,200/month at 70.

Waiting might not always be best, but making an informed decision based on life expectancy, spousal benefits, and income needs is crucial.

Not all your income has to be guaranteed. A bucket strategy divides your assets into time horizons:

This approach balances security and growth while ensuring you never have to sell assets during a downturn.

Inflation silently erodes purchasing power over time. Even a modest 3% inflation rate can cut your buying power in half over 25 years.

Solutions to consider:

Combining these helps maintain your standard of living even as prices rise.

Required Minimum Distributions (RMDs) begin at age 73 for many retirees and can create taxable income spikes. A tax-efficient income plan may include:

Your goal isn’t just income—it’s after-tax income that lasts.

When your income is predictable, your lifestyle becomes sustainable. Instead of worrying about market headlines or interest rate swings, you can focus on what really matters: living your retirement with confidence and purpose.

The best income plans combine:

Guarantees (annuities, Social Security)

Guarantees (annuities, Social Security)

Flexibility (investments, cash reserves)

Flexibility (investments, cash reserves)

Protection (insurance, estate planning)

Protection (insurance, estate planning)

Together, they create the foundation for your lifetime paycheck plan.

Your retirement shouldn’t feel like a guessing game. With the right strategy, your savings can become the reliable income you’ve worked for your entire life.

This Financial Planning Awareness Month, take time to review your income sources and speak with a financial professional about turning your assets into guaranteed income streams. The sooner you start, the more confidence you’ll gain.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of experience helping families navigate retirement and legacy planning, Brent is committed to making financial education simple, clear, and trustworthy.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of experience helping families navigate retirement and legacy planning, Brent is committed to making financial education simple, clear, and trustworthy.

This article is for informational and educational purposes only and does not constitute financial, legal, or tax advice. Consult a licensed professional for advice specific to your situation. SafeMoney.com is not affiliated with or endorsed by any government agency.

The post Turning Savings Into Income: Your Lifetime Paycheck Plan first appeared on SafeMoney.com.

]]>The post The Cost of Waiting: Don’t Delay Your Financial Plan first appeared on SafeMoney.com.

]]>When it comes to financial planning, doing nothing can be the most expensive decision of all. Every year you delay taking action—whether it’s buying life insurance, starting an annuity, or repositioning investments—you lose something that can’t be recovered: time.

October’s National Financial Planning Awareness Month serves as a reminder that financial confidence begins with early preparation. And waiting even a few years can have lasting consequences on your income, security, and peace of mind.

Compounding is often called the “eighth wonder of the world” for a reason—it rewards time, not timing.

Let’s say you plan to start saving $500 a month for retirement at age 50. If you wait just five years—until age 55—you’ll end up with nearly 30% less at retirement, even if you earn the same rate of return.

The takeaway: The earlier you start, the less money you have to put in to reach your goals.

Financial markets move constantly, and waiting can mean buying in at a less favorable time. The same is true for annuities or life insurance—interest rate environments and product designs change.

Safe Money Strategy: By incorporating fixed or fixed indexed annuities, you can capture growth opportunities now while locking in downside protection for the future.

Life insurance and long-term care coverage are priced based on age and health. Waiting just one year to apply could increase your premiums—or worse, you may become uninsurable due to a health change.

Example:

A 60-year-old applying for the same permanent life policy might pay 40–50% more than a 55-year-old.

The takeaway: Protecting your health and insurability early often saves thousands over time.

Tax-efficient planning is a year-round strategy, but waiting until later can limit your options.

Smart move: Work with an advisor to evaluate year-end opportunities before December 31. October is the perfect time to start.

Delaying your plan can also increase the risk of outliving your money. The longer you wait to secure guaranteed income sources, the less monthly income you can lock in for life.

Example: A 60-year-old purchasing a lifetime income annuity today might receive $6,000 annually per $100,000 invested. Waiting until age 65 might reduce that income to $5,000—simply because there are fewer years to accumulate deferred growth.

In other words: Waiting doesn’t just cost you time—it can cost you income for the rest of your life.

Beyond dollars and cents, waiting to plan often leads to stress, uncertainty, and missed opportunities.

When people delay:

Conversely, those who plan early often experience the opposite—confidence, calm, and clarity.

Here’s how you can take meaningful action this month:

Review Your Current Situation

Review Your Current SituationAssess income sources, debt, insurance coverage, and long-term care needs.

Create a Retirement Timeline

Create a Retirement TimelineIdentify when you want to retire and what income sources will start when.

Protect Your Future Income

Protect Your Future IncomeConsider guaranteed income options, such as annuities, that remove market uncertainty.

Update Beneficiaries and Estate Plans

Update Beneficiaries and Estate PlansSmall administrative updates today can prevent major issues for your loved ones later.

Mark and Linda, both 58, delayed their retirement planning because they “weren’t ready.” Two years later, market volatility reduced their 401(k)s by 20%, and Linda’s health condition made her ineligible for affordable long-term care coverage.

By waiting, they lost both time and options. Had they started earlier, they could have:

The truth is simple: every delay has a price tag. Whether it’s missed compounding, higher taxes, or reduced insurance options, waiting to act rarely saves money—it costs it.

But the good news is it’s never too late to begin. Taking even one small step today—scheduling a financial review, exploring income options, or updating your plan—can make all the difference.

Don’t let procrastination dictate your retirement future. Use this Financial Planning Awareness Month as a turning point to take control of your finances, protect your family, and secure your lifetime income.

Your future self will thank you.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of experience helping families navigate retirement and legacy planning, Brent is committed to making financial education simple, clear, and trustworthy.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of experience helping families navigate retirement and legacy planning, Brent is committed to making financial education simple, clear, and trustworthy.

Disclaimer: This content is for informational and educational purposes only and should not be considered personalized financial, tax, or legal advice. Consult with a licensed financial professional regarding your individual situation. SafeMoney.com is not affiliated with or endorsed by any government agency.

The post The Cost of Waiting: Don’t Delay Your Financial Plan first appeared on SafeMoney.com.

]]>The post How to Calculate Your Retirement Income Gap (Why It Matters) first appeared on SafeMoney.com.

]]>For many retirees, the fear isn’t dying too soon—it’s living too long without enough money. Even diligent savers can discover that Social Security and investments alone may not cover all their expenses. That’s where the concept of an “income gap” comes in.

Your retirement income gap is the difference between what you’ll need to live comfortably and the reliable income you’ll have coming in.

According to the Employee Benefit Research Institute, only about 1 in 3 retirees feel “very confident” their savings will last their lifetime. This lack of confidence usually comes down to not knowing how big their income gap really is—or how to close it.

To calculate your gap, first outline what you’ll need annually in retirement. Be sure to include:

Example: You expect to spend $70,000 per year in retirement, including essentials and lifestyle extras.

Example: You expect to spend $70,000 per year in retirement, including essentials and lifestyle extras.

Next, identify your predictable, guaranteed income streams. These may include:

Example: Between Social Security ($28,000) and a small pension ($12,000), you’ll receive $40,000 per year guaranteed.

Example: Between Social Security ($28,000) and a small pension ($12,000), you’ll receive $40,000 per year guaranteed.

Subtract guaranteed income from projected expenses.

Example: $70,000 (expenses) – $40,000 (guaranteed income) = $30,000 income gap per year.

Example: $70,000 (expenses) – $40,000 (guaranteed income) = $30,000 income gap per year.

This gap will need to be filled by withdrawals from savings or other income strategies.

Suppose you’ve saved $500,000 in retirement accounts. How long will that last if you need to pull $30,000 per year, especially during market downturns?

This is why relying solely on savings can be risky—especially with people living into their 90s.

An annuity can turn part of your savings into a personal pension, guaranteeing income for life. FIAs in particular allow for potential growth without market losses, making them popular for bridging income gaps.

Benefit: Removes guesswork. You’ll know that part of your gap is permanently covered.

Claiming Social Security at age 62 may be tempting, but delaying can increase your benefit by as much as 8% per year until age 70.

Benefit: A higher monthly check for life reduces your gap.

Permanent life insurance can build cash value, which may be tapped for supplemental income. Some policies even include long-term care riders, helping with medical expenses that otherwise widen your gap.

Taxes reduce the money you keep. Strategies like Roth conversions, charitable giving, or managing withdrawals across different account types can shrink the income gap by lowering your tax burden.

Sometimes filling the gap isn’t about more income—it’s about trimming expenses. Downsizing a home, cutting debt, or adjusting travel expectations can close the gap without financial strain.

Taking Action Today

National Financial Planning Awareness Month is the perfect reminder to measure your retirement income gap and take action.

Ask yourself:

If the answer is “no” or “I’m not sure,” now is the time to work with a qualified financial professional.

Knowing your retirement income gap gives you control. Instead of hoping your savings will last, you’ll have a clear plan to bridge the shortfall with guaranteed income, smart tax moves, and careful lifestyle planning.

Small steps now can turn uncertainty into confidence—and help you enjoy retirement the way you’ve always envisioned.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of experience helping families navigate retirement and legacy planning, Brent is committed to making financial education simple, clear, and trustworthy.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of experience helping families navigate retirement and legacy planning, Brent is committed to making financial education simple, clear, and trustworthy.

Disclaimer: This article is for informational purposes only and should not be considered financial, legal, or tax advice. Please consult a licensed financial professional about your individual situation. SafeMoney.com is not affiliated with or endorsed by any government agency.

The post How to Calculate Your Retirement Income Gap (Why It Matters) first appeared on SafeMoney.com.

]]>The post October Is National Financial Planning Awareness Month first appeared on SafeMoney.com.

]]>Every October, National Financial Planning Awareness Month serves as a reminder to pause, reflect, and take action on your long-term financial goals. Just as people use spring for “cleaning up” their homes, October is a chance to organize your financial life before year-end.

For retirees and those approaching retirement, this awareness month is more than just a calendar event—it’s an opportunity to evaluate whether your plan for income, taxes, insurance, and investments is truly built to last a lifetime.

At SafeMoney.com, we created this article to answer the most common questions retirees and pre-retirees have about financial planning, retirement income strategies, and how new laws, taxes, and market conditions can impact your nest egg.

National Financial Planning Awareness Month was established to highlight the importance of setting financial goals, creating a strategy to reach them, and making sure your plan stays on track as life changes.

Key aspects include:

When done right, financial planning isn’t about restricting yourself—it’s about creating confidence and security for the future.

With inflation, rising healthcare costs, and uncertainty in the markets, today’s retirees face challenges previous generations didn’t. According to the Insured Retirement Institute, only about 24% of Baby Boomers are confident they have enough saved to last through retirement.

October is the perfect time to reassess your strategy because:

Ask yourself: Do you know exactly how much income will come from Social Security, pensions, annuities, and your investments? Many people underestimate how much they’ll need.

Tip: Traditional rules of thumb—like the “4% withdrawal rule”—may no longer be reliable in today’s environment of longer lifespans, higher healthcare costs, and unpredictable markets. Instead of relying on a single percentage, consider building a retirement income plan that blends guaranteed sources (such as annuities or pensions) with flexible withdrawals from savings and investments. This approach can help ensure your money lasts as long as you do, no matter what the markets bring.

Tip: Traditional rules of thumb—like the “4% withdrawal rule”—may no longer be reliable in today’s environment of longer lifespans, higher healthcare costs, and unpredictable markets. Instead of relying on a single percentage, consider building a retirement income plan that blends guaranteed sources (such as annuities or pensions) with flexible withdrawals from savings and investments. This approach can help ensure your money lasts as long as you do, no matter what the markets bring.

The last few years have shown how quickly markets can shift. If too much of your retirement money is exposed to volatility, a downturn could force you to lock in losses.

Safe Money Strategy: Consider products like fixed indexed annuities, which allow you to participate in potential market gains without suffering losses from downturns.

Medicare doesn’t cover everything, and long-term care can quickly drain savings. Exploring solutions like hybrid annuities or life insurance with long-term care riders can provide extra protection.

Retirement isn’t just about how much you have saved—it’s about how much you keep after taxes. Roth conversions, charitable giving strategies, and careful RMD planning can help reduce lifetime tax burdens.

Your estate plan is more than just a will—it includes trusts, beneficiary designations, and powers of attorney. Keeping this updated ensures your wealth is transferred smoothly and in line with your wishes.

Two tools often misunderstood, but essential, are life insurance and annuities.

Together, these solutions help balance growth, protection, and income in retirement.

Financial planning awareness month is also about education. Without financial literacy, it’s easy to make costly mistakes, like claiming Social Security too early, taking unnecessary investment risks, or neglecting tax strategies.

Improving your financial literacy means asking questions, reading trusted resources, and working with advisors who focus on your goals—not just selling products.

Truth: Everyone benefits from a plan, even if you’re just starting or living on a modest income.

Truth: Everyone benefits from a plan, even if you’re just starting or living on a modest income. Truth: On average, Social Security replaces only about 40% of pre-retirement income. Most people need 70–80%.

Truth: On average, Social Security replaces only about 40% of pre-retirement income. Most people need 70–80%. Truth: While some annuities can be complex, fixed and fixed indexed annuities are straightforward and focus on income security.

Truth: While some annuities can be complex, fixed and fixed indexed annuities are straightforward and focus on income security.Financial planning isn’t a one-time event—it’s an ongoing process. This October, commit to at least one action step:

Even small steps now can create major confidence later.

Throughout October, we’ll be publishing articles on:

Stay tuned each week for insights designed to help you move from confusion to confidence with your retirement planning.

October’s National Financial Planning Awareness Month is the perfect time to step back and ask: Am I truly prepared for the future? By reviewing income strategies, tax planning, insurance coverage, and estate documents, you’ll gain more peace of mind—and a stronger plan to protect what matters most.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of experience helping families navigate retirement and legacy planning, Brent is committed to making financial education simple, clear, and trustworthy.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of experience helping families navigate retirement and legacy planning, Brent is committed to making financial education simple, clear, and trustworthy.

Disclaimer: This article is for educational purposes only and should not be considered financial, tax, or legal advice. Consult with a licensed professional regarding your specific situation. SafeMoney.com is not affiliated with or endorsed by any government agency.

The post October Is National Financial Planning Awareness Month first appeared on SafeMoney.com.

]]>The post The Great Wealth Transfer: What Families Should Know first appeared on SafeMoney.com.

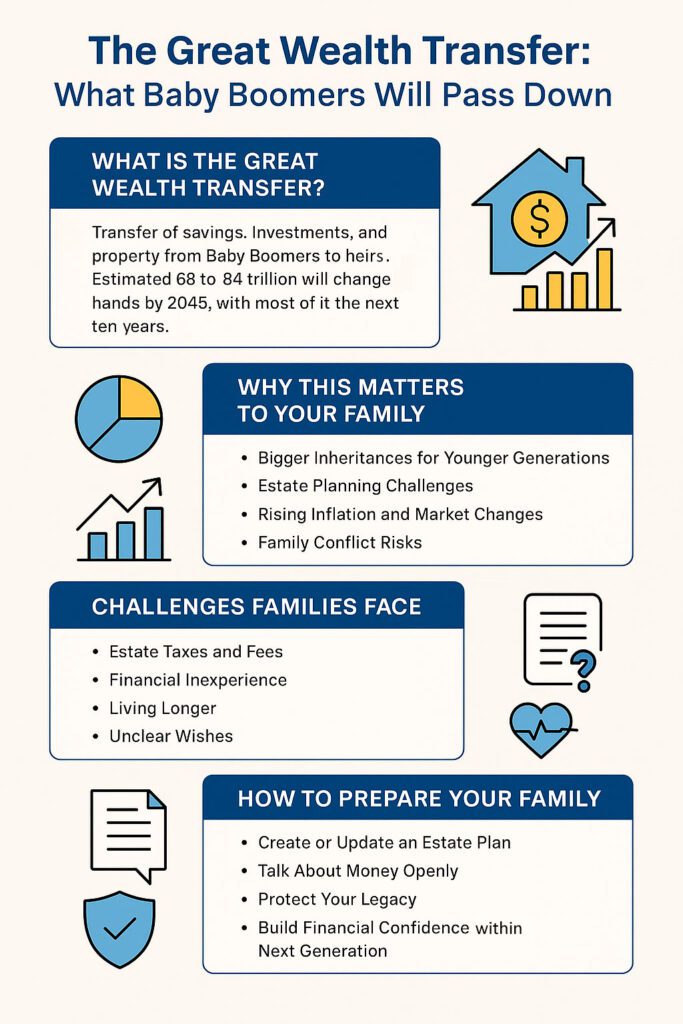

]]>It’s estimated that $68 to $84 trillion will change hands by 2045, with most of that happening in the next ten years. For families, this shift will bring both opportunities and challenges. Preparing now can make the difference between building a stronger legacy—or watching wealth disappear to taxes, fees, or disputes.

The Great Wealth Transfer refers to the massive movement of assets—savings, investments, businesses, and property—from Baby Boomers to their heirs. This includes:

Baby Boomers currently hold over half of U.S. household wealth, and as they age, that wealth will steadily move to children and grandchildren.

The Great Wealth Transfer will reshape finances for millions of American families. Here’s how it could impact yours:

Millennials and Gen X may use inheritances to pay off debt, buy homes, invest, or fund retirement. Without a plan, though, much of this wealth could be wasted.

Families without updated wills or trusts may face delays, higher taxes, and costly legal battles.

Passing money on is one thing—ensuring it keeps its value is another. Inflation can quietly erode wealth if not managed.

Without clear communication, inheritances can create disagreements that tear families apart.

Not all families will benefit equally. Much of the wealth transfer will occur among higher-income households.

Here are the most common obstacles families encounter when passing wealth to the next generation:

The Great Wealth Transfer isn’t just about money—it’s about values, security, and peace of mind. Families can take important steps today to prepare:

Today’s digital tools make it easier than ever for families to prepare:

The Great Wealth Transfer is already underway—and it’s the largest shift of money in American history. Families that prepare now will preserve more wealth, reduce conflict, and pass down not just money, but values and security for generations to come.

Take the time to review your estate plan, talk openly with your family, and work with trusted professionals who can guide you through the process. The choices you make today will shape your family’s financial future tomorrow.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of experience helping families navigate retirement and legacy planning, Brent is committed to making financial education simple, clear, and trustworthy.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of experience helping families navigate retirement and legacy planning, Brent is committed to making financial education simple, clear, and trustworthy.

Disclaimer: This article is for educational purposes only and should not be considered financial, tax, or legal advice. Everyone’s situation is unique. Please consult a licensed financial professional before making decisions about estate planning or wealth transfer.

The post The Great Wealth Transfer: What Families Should Know first appeared on SafeMoney.com.

]]>The post Permanent vs. Term Life Insurance: What’s the Difference? first appeared on SafeMoney.com.

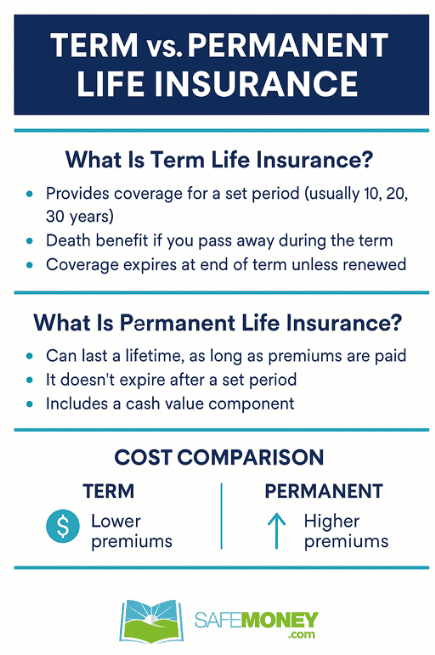

]]>While both provide financial protection for your loved ones, they work very differently — and choosing the wrong one could cost you money or leave gaps in coverage. In this guide, we’ll break down the differences between term and permanent life insurance, the pros and cons of each, and how to decide which may be right for you.

Term life insurance is the simplest and most affordable form of life insurance.

Think of it as renting life insurance: you pay for protection while you need it, but when the term is over, the coverage disappears.

Permanent life insurance lasts for your entire lifetime, as long as premiums are paid. Unlike term, it doesn’t expire after a set period.

Permanent insurance also has a cash value component, which works like a built-in savings account. Part of your premium goes toward building this cash value, which grows tax-deferred over time. You can borrow against it, withdraw it, or use it to help pay premiums.

One of the biggest differences is cost.

Example:

The best choice depends on your financial goals, family situation, and long-term needs.

Many families use a combination of both — for example, purchasing a large term policy for income protection while adding a smaller permanent policy for lifetime needs.

Both term life insurance and permanent life insurance can play important roles in protecting your loved ones. Term is cost-effective and temporary, while permanent offers lifetime protection and savings. The right choice depends on your unique needs, budget, and long-term goals.

Life insurance is not just about numbers — it’s about peace of mind. Having a trusted advisor guide you through your options ensures you make the right decision for your family.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of hands-on experience in annuities and retirement planning, Brent is committed to helping Americans make informed, confident financial decisions.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of hands-on experience in annuities and retirement planning, Brent is committed to helping Americans make informed, confident financial decisions.

Disclaimer: This article is for educational purposes only and should not be considered financial, tax, or legal advice. Indexed Universal Life policies vary by insurer and state, and guarantees are subject to the claims-paying ability of the issuing company. Consult with a licensed financial professional before making decisions.

The post Permanent vs. Term Life Insurance: What’s the Difference? first appeared on SafeMoney.com.

]]>The post One Big Beautiful Bill: What Retirees Need to Know first appeared on SafeMoney.com.

]]>We created this article to answer the most common questions retirees and pre-retirees have about how new laws impact life insurance, taxes, and income planning. Our goal is to break down the bill in simple terms, explain the pros and cons, and help you understand what it may mean for your retirement strategy.

The One Big Beautiful Bill Act of 2025 is a large tax and spending law that makes permanent some earlier tax provisions, creates temporary benefits for seniors, and reduces funding for several federal programs.

Here are the key highlights:

For retirees 65 or older, the extra deduction can significantly reduce taxable income. Many retirees with modest incomes may pay no federal tax on Social Security.

Uncertainty around expiring tax cuts has worried pre-retirees for years. Now, with brackets locked in, you can plan Roth conversions, withdrawals, or savings contributions with more confidence.

For retirees in states with high property or income taxes, the raised cap on the SALT deduction may lower federal tax bills if you itemize.

With more certainty around tax rates, both pre- and post-retirees can better project future income needs and create strategies that align with long-term goals.

The extra senior deduction ends after 2028 unless Congress acts again. That means planning too far ahead with this break could create surprises later.

Medicaid and other programs will see reductions, which could increase out-of-pocket medical or long-term care costs for older Americans.

The senior deduction begins to phase out at $75,000 of income for singles and $150,000 for couples. It disappears completely at higher levels, limiting benefits for upper-middle-income retirees.

By cutting programs and increasing deficits, the bill may force future tax hikes or spending changes. Retirees should be ready for additional adjustments.

If you’re still working or a few years away from retirement, the bill impacts you in several ways:

If you’re already retired, you’ll notice changes sooner:

What’s the biggest win for retirees?

What’s the biggest win for retirees?The extra senior deduction—up to $6,000 for singles or $12,000 for couples—which may eliminate taxes on Social Security for many households.

What’s the biggest risk?

What’s the biggest risk?Cuts to Medicaid and other safety-net programs could make healthcare and long-term care more expensive.

Do higher-income retirees benefit?

Do higher-income retirees benefit?Not as much. The senior deduction phases out with higher incomes, and those in top brackets see fewer advantages.

Is this permanent?

Is this permanent?Some parts are permanent (lower brackets), but others (senior deduction, SALT relief) end in 2028 unless extended.

How should I plan around this?

How should I plan around this?Work with a financial advisor to project taxes with and without these breaks. Consider Roth conversions, maximizing deductions, and planning for healthcare costs.

The One Big Beautiful Bill brings both opportunities and risks for retirees. On the positive side, it reduces taxes for many seniors, extends lower brackets, and provides short-term relief on Social Security taxation. But it also reduces funding for essential programs, phases out benefits for higher earners, and may create long-term uncertainty.

For both pre-retirees and post-retirees, the key is proactive planning. By understanding how the law affects your income, taxes, and healthcare costs, you can make informed choices that protect your retirement security.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of hands-on experience in annuities and retirement planning, Brent is committed to helping Americans make informed, confident financial decisions.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of hands-on experience in annuities and retirement planning, Brent is committed to helping Americans make informed, confident financial decisions.

Disclaimer: This article is for educational purposes only and should not be considered tax, legal, or financial advice. The information provided is based on publicly available details of the One Big Beautiful Bill (2025) at the time of writing and may change with future updates or amendments.

SafeMoney.com is not affiliated with any government agency or program and does not provide individualized tax or legal recommendations. Readers should consult with a qualified tax professional, financial advisor, or attorney before making decisions that may affect their personal retirement planning, Social Security benefits, or healthcare coverage.

The post One Big Beautiful Bill: What Retirees Need to Know first appeared on SafeMoney.com.

]]>The post The Role of Life Insurance in a Comprehensive Retirement first appeared on SafeMoney.com.

]]>From income protection and tax advantages to legacy planning and long-term care support, the right policy can help retirees achieve peace of mind well beyond their working years.

Even if your kids are grown and your mortgage is nearly paid off, life insurance may still be valuable. Retirement planning isn’t just about ensuring you have enough money to live on — it’s also about protecting your loved ones, creating flexibility, and reducing financial risks.

Life insurance can:

In short, life insurance isn’t just for the early years of financial responsibility — it can be a powerful asset throughout retirement.

For couples, retirement often relies on two sources of income, whether from Social Security, pensions, or retirement accounts. When one spouse passes away, the surviving partner may lose a significant portion of that income.

Life insurance can help bridge the gap by providing a tax-free death benefit that replaces the lost income stream. This ensures the surviving spouse can maintain their standard of living without draining retirement accounts prematurely.

Example: If a couple relies on two Social Security checks, losing one may cut their monthly income by thousands. A life insurance policy can help fill that gap for years to come.

Certain types of life insurance, such as whole life and indexed universal life (IUL), build cash value over time. This cash value grows tax-deferred and can be accessed during retirement through policy loans or withdrawals.

Benefits include:

While life insurance should never replace retirement accounts like 401(k)s or IRAs, it can serve as a tax-efficient supplement to those plans.

Policy loans can be a useful feature of permanent life insurance, but they don’t always work the way people expect. Here’s what you need to know:

Policy loans can be powerful, but they require careful management to avoid unintended consequences.

One of the biggest threats to retirement savings is the cost of long-term care. Nursing homes, assisted living, and in-home care can drain assets quickly. Traditional long-term care insurance has become expensive and less available, but life insurance policies with long-term care riders offer an alternative.

These hybrid policies allow you to:

This dual-purpose protection makes modern life insurance an appealing option for retirees concerned about healthcare costs.

For many retirees, leaving a financial legacy is a priority. Life insurance provides a simple and efficient way to transfer wealth to the next generation or to charitable causes.

Key benefits include:

Life insurance ensures that your retirement plan doesn’t just support you while you’re alive but also protects your family after you’re gone.

Despite its benefits, many people overlook life insurance in retirement because of myths:

By addressing these misconceptions, retirees can see life insurance as part of a balanced retirement strategy, not just an expense.

Not all policies are created equal. Here are a few factors to consider:

Working with an independent advisor can help you compare options across multiple insurance carriers to find the best fit for your retirement plan.

Retirement planning is about more than just accumulating savings — it’s about protecting income, managing risks, and leaving a lasting impact. Life insurance can provide all three.

From protecting your spouse to offering tax advantages, covering long-term care, and ensuring a smooth wealth transfer, life insurance is a versatile tool that belongs in many retirement conversations.

At SafeMoney.com, we help people see the bigger picture. Whether you’re approaching retirement or already there, our resources and advisors can guide you toward a comprehensive plan that includes life insurance where it makes sense.

With the right strategy, life insurance can provide peace of mind today and financial security for tomorrow.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of hands-on experience in annuities and retirement planning, Brent is committed to helping Americans make informed, confident financial decisions.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of hands-on experience in annuities and retirement planning, Brent is committed to helping Americans make informed, confident financial decisions.

Disclaimer: This article is for educational purposes only and should not be considered financial, tax, or legal advice. Indexed Universal Life policies vary by insurer and state, and guarantees are subject to the claims-paying ability of the issuing company. Consult with a licensed financial professional before making decisions.

The post The Role of Life Insurance in a Comprehensive Retirement first appeared on SafeMoney.com.

]]>